News

Kidnappers of Catholic priest demand N50m ransom

Kidnappers of Catholic priest Rev. Fr. Dr. Chinedu Nwadike have requested N50 million as ransom for his release.

Close sources said contact was made by the gunmen late Saturday night.

The priest was kidnapped Friday at the notorious Umunnochi, along Okigwe – Enugu Road, Abia State.

He was kidnapped alongside a seminarian while on their way to Enugu for an official assignment.

Dr Nwadike is currently the deputy registrar of SUN (Spiritan University Nneochi).

A close source said the priest had just left the school when he was abducted.

Our source also said that the priest had escaped an earlier kidnap attempt along the same road.

News

Gunmen kill Police Inspector in Rivers

Suspected armed robbers on Wednesday night killed a Nigerian police officer identified as Inspector Sunday Baba during their operation at Rumuolumeni in Rivers State.

This was confirmed by the Rivers State command on its X account.

The command mourned the death of the deceased described as a ‘brave man’ who lost his life on duty.

The command wrote: “Yesterday night, Inspr Sunday Baba, a brave police officer serving at Rumuolumeni, Rivers State, lost his life on duty.

“Though the perpetrators fled, we recovered their vehicle. It’s sad that being a police officer means leaving home in good health, never certain of your return.”

News

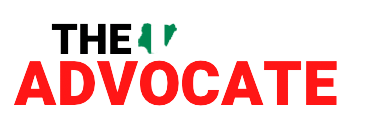

Govt opens Nigerians’ access to consumer credit with N100b

• Govt opens Nigerians’ access to consumer credit with N100b

A Consumer Credit Scheme to put money in the pockets of Nigerians, boost manufacturing and stimulate economic growth has been rolled out by the Federal Government.

Presidential spokesman Ajuri Ngelale on Wednesday announced the beginning of the plan following its approval by President Bola Ahmed Tinubu.

It is a cardinal campaign promise by the President.

According to Ngelale, apart from empowering Nigerians to improve their quality of life, the programme will also lead to access to goods and services.

The first phase of the programme will be available to civil servants before its extension to other Nigerians.

Ngelale explained: “Consumer credit serves as the lifeblood of modern economies, enabling citizens to enhance their quality of life by accessing goods and services upfront, paying responsibly over time.

“It facilitates crucial purchases, such as homes, vehicles, education, and healthcare, essential for ongoing stability to pursue their aspirations.

“Through responsible repayment, individuals build credit histories, unlocking more opportunities for a better life.

“Additionally, the increased demand for goods and services will stimulate local industry and job creation.

“The President believes every hardworking Nigerian should have access to social mobility, with consumer credit playing a pivotal role in achieving this vision.

“The Nigerian Consumer Credit Corporation (CREDICORP), which will drive the scheme, will achieve its mandate through the following:

*Strengthening Nigeria’s credit reporting systems, ensuring every economically active citizen has a dependable credit score. This score becomes personal equity they build, facilitating access to consumer credit.

*Offering credit guarantees and wholesale lending to financial institutions dedicated to broadening consumer credit access.

*Promoting responsible consumer credit as a pathway to an improved quality of life, fostering a cultural shift towards growth and financial responsibility.

“In line with the President’s directive to expand consumer credit access to Nigerians, CREDICORP has launched a portal for Nigerians to express interest in receiving consumer credit.

“This initiative, in collaboration with financial institutions and cooperatives nationwide, aims to broaden consumer credit availability.

“Working Nigerians interested in receiving consumer credit can visit www.credicorp.ng to express interest. The deadline is on May 15.”

In an earlier comment on the scheme, Minister for Budget and Economic Planning, Abubakar Bagudu, noted that N100 billion is included in this year’s budget for the programme

He said: “We put N100 billion fund in the budget to support consumer credit.

“This is important because the manufacturing sector is struggling with two challenges: efficiency of production and finding someone who can buy.

“The introduction and support of consumer credit, we believe, will help in the revival of our manufacturing sector to meet international standards. It is a catalytic fund that is expected to have significant growth.”

House of Representatives Speaker Tajudeen Abbas, and economic experts, such as Dr. Muda Yusuf, Mr. Olatunde Amolegbe and Mr. David Andori, gave kudos to the scheme.

The absence of recent and relevant credit demand data poses challenges to operators and investors, leaving them “market-blind” in estimating Nigeria’s actual consumer credit market size, according to experts.

To address this issue, Stears, a leading data analysis firm, has developed a credit market mapping model that leverages robust data and innovative methodologies to comprehensively understand Nigeria’s consumer credit market.

This includes not only assessing the formal market but also offering insights into the substantial informal credit market, thus identifying opportunities for credit providers and investors within this segment.

The experts added that consumer credit can have both positive and negative impacts on the economy.

On the positive side, it can stimulate economic growth by increasing consumer spending. When individuals have access to credit, they are more likely to make purchases, driving demand for goods and services and leading to increased production and job creation.

This, in turn, can boost overall economic activity and contribute to higher levels of economic growth.

However, it is crucial to manage consumer credit responsibly to avoid negative consequences.

Excessive consumer debt can lead to financial instability, as individuals may struggle to repay their debts, resulting in defaults and bankruptcies.

These repercussions can have a ripple effect on the economy, causing lenders to incur losses and reducing their willingness to extend credit in the future.

Moreover, high levels of consumer debt can hinder long-term economic growth by reducing savings and investment.

Yusuf, Amolegbe, Andori on the scheme

Economic and finance experts described the takeoff of the consumer credit scheme as laudable.

They noted that it has the potential to stimulate the economy and enhance the quality of living of average Nigerians.

They said a functional credit scheme not only provides an opportunity to lift a substantial part of the population from poverty but also to create massive opportunities for the development of the productive and financial services sectors.

They, however, called for supportive regulatory and policy frameworks to make the scheme sustainable and successful.

The experts that spoke yesterday include Chief Executive Officer of the Centre for Promotion of Private Enterprise (CPPE); Dr Muda Yusuf; Managing Director, Arthur Steven Asset Management, Mr Olatunde Amolegbe and Managing Director, HighCap Securities, Mr David Adonri.

Yusuf said the introduction of the consumer credit scheme is a welcome development as it would boost consumer demand.

“One of the major shortcomings of our financial system is the absence of consumer credit. Where it exists, the conditions are often very difficult to meet.

“The resultant enhancement of purchasing power would be beneficial to other sectors of the economy. We need robust consumption capabilities to complement production.

“But the implementation framework should be such that would deliver the desired outcomes,” Yusuf said.

Amolegbe noted that the Nigerian economy cannot reach its full potential if it remains a largely informal and cash-based economy.

According to him, the availability of credit means consumers can leverage their incomes in other to buy more, thus indirectly boosting production, capacity utilisation and employment

“It will also have a significant social economic impact as it has the potential to lift many people out of poverty by providing them credit to finance their small businesses and trades,” Amolegbe, a past president of the Chartered Institute of Stockbrokers (CIS), said.

He, however, pointed out the need to ensure a proper and workable framework, especially when the scheme becomes accessible to operators in both formal and informal sectors.

“The pitfalls include: how do you properly capture and monitor borrowers to ensure they make good on their commitments in a country dominated by people operating in a largely unstructured and informal environment?

“If we can overcome this hurdle, then the benefits of this scheme will be clear for all to see within a short period,” Amolegbe said.

Adonri said the scheme was in line with the global operating environment, noting that it has the potential to boost the economy if well managed.

“Modern economies run on credit. Therefore, it is a commendable initiative to make consumer credit readily available in Nigeria.

“However, it may aggravate the galloping inflation in Nigeria now. The main economic challenge facing Nigeria comes from the excessive supply gap due to the near collapse of domestic agricultural and industrial production.

“Consumer credit is a potent tool for stimulating consumer pull, especially when an economy is be-labored with unsold inventory,” Adonri said.

He said macroeconomic policy thrust now ought to be focused on the mobilisation of credit to boost local production to close the yawning supply gap, as a condition precedent to support the consumer credit system.

News

EFCC hands over 14 forfeited properties to Enugu State

• Assets to be deployed to optimum benefit of Enugu people – Gov Mbah

The Economic and Financial Crimes Commission, EFCC on Wednesday, released 14 properties initially forfeited to the Federal Government to Enugu State Government, following the request by the Governor Peter Mbah administration.

The properties were handed over to Governor Mbah by the Executive Chairman of EFCC, Mr Ola Olukoyede, during a brief ceremony at the agency’s corporate headquarters in Abuja.

This was even as Governor Mbah assured that the recovered assets would be used to the optimum benefit of the people of Enugu State.

Speaking at the event, Olukoyede, who disclosed that the road to the forfeiture dated back to 2007, said the event spoke of the mutually beneficial relationship existing between the federal government and states.

Commending Dr. Mbah “for the great work he is doing in Enugu State”, the EFCC Chairman said the President was very much interested in the state-of-the-art hospital that the Mbah administration proposed to build in Enugu State, saying the structures for medical facilities among the released assets would go a long way in helping to realise the Mbah vision for the benefit of not just Enugu State, but the entire country and beyond.

EFCC Chairman, Olukoyede, Gov Peter Mbah with other officials during the visit

“What we are witnessing today testifies to a symbiotic relationship that should exist between the federal government and the state governments. The essence of our meeting here today is for us to handover properties that were forfeited to the federal government, which of course belong to Enugu State people, back to the people. It shows that governance can work in Nigeria.

“If you look at the history of this particular matter, it takes us back to 2007 when we started the prosecution. So, we are looking at about 17 years since the matter has been on. Eventually some of the properties were forfeited and since then, the EFCC has been managing those properties even though the titles of quite a number of the properties have been revoked by the Enugu State government,” Olukoyede said.

Earlier in his remarks, Governor Mbah, who noted that the properties were forfeited not to his state but to the federal government, expressed gratitude to President Bola Tinubu for making it possible for the assets to be returned to the government and people of Enugu State.

“The importance and significance of this event can never be lost on us and we do not also take it for granted. Those assets were forfeited to the federal government. And this brings me to another gratitude that I want to convey here today. So, I want to acknowledge and recognise the important role played by the President, His Excellency Bola Ahmed Tinubu. Without the proactiveness and speed at which he acted on our request to cede these assets back to the people and government of Enugu State, we wouldn’t have been here today. Therefore, I want to thank him most sincerely for granting our request for these assets that were forfeited to the federal government to be ceded back to Enugu State.

“I want to assure us that those properties would be used for the benefit of the people of Enugu state. All the assets without any exemption, and they would be deployed to optimum use for the benefit of the people of Enugu state.”

He also lauded Olukoyede’s initiatives at making the EFCC a strong institution and the role of the EFCC in the release of the properties to the state.

“I will not end this remark without acknowledging the work the EFCC chairman and his team are doing in strengthening this very important institution. Thank you very much particularly for the effort that you have put in to make today a reality,” the governor stated.

The properties comprise houses, transmission equipment for radio and television stations, a building for medical operations, among others.

-

News2 days ago

News2 days agoYahaya Bello: NBA disowns protest by lawyers

-

Education2 days ago

Education2 days agoAbuja British School shuts down over bullying, assault of female student

-

News20 hours ago

News20 hours agoEFCC hands over 14 forfeited properties to Enugu State

-

News21 hours ago

News21 hours agoFather caught writing UTME for son arrested by JAMB

-

News2 days ago

News2 days ago‘EFCC is an illegal organisation,’ Ex-governor Yahaya Bello tells court

-

News21 hours ago

News21 hours agoAlleged N80.2bn fraud: EFCC withdraws appeal against Yahaya Bello

-

Politics2 days ago

Politics2 days agoEx-Imo gov, Emeka Ihedioha resigns from PDP

-

News2 days ago

News2 days agoJUST IN: Emefiele printed N684.5m with N18.9bn, says EFCC in fresh charge